Retirement in Our Village: Practical Steps to a Smoother Next Chapter

Thinking about retirement? You don’t need complex plans to make better choices. Start with a few clear actions you can do this month.

First, list your income sources. Include pensions, savings, part-time work, and any government benefits. Write down amounts and expected start dates. Knowing the numbers removes surprises.

Money and benefits

Check your pension options early. Contact your pension provider and ask for a statement that shows projected payments at different retirement ages. If you have multiple pensions, consider consolidating them for easier tracking. Look into government benefits and how your income affects eligibility.

Simplify regular bills. Automate payments and cancel subscriptions you no longer need. Small savings on utilities and services add up over a year. If debt exists, focus on clearing high-interest loans first.

Create a short budget for essentials and one for extras. Essentials cover housing, food, medicine, and insurance. Extras pay for hobbies, trips, and gifts. Keep an emergency fund equal to three months of essentials.

Health, home and purpose

Review your health cover. Compare local clinics and find out which medications are subsidized. Book routine health checks and set reminders for appointments. Good health habits now reduce care costs later.

Think about your home. Do you want to stay where you are, downsize, or move closer to family? List what you like and what causes daily strain. Minor changes like grab bars or a walk-in shower make staying at home easier.

Plan for how you’ll spend your days. Part-time work, volunteering, or a class keep your skills sharp and social life active. Choose at least two activities you can try within six months.

Sort legal papers. Update your will, set a durable power of attorney, and write a simple plan that lists bank accounts, insurance, and key contacts. Store copies with someone you trust and tell them where they are.

Use local resources. Our Village Gazette covers local pension clinics, council events, and community groups. Attend a local information session before making big moves.

Talk openly with family. Share financial plans and health wishes so decisions are easier when time is tight. If you prefer privacy, still choose one trusted person to know the basics.

Finally, test one change this month. Call your pension office, book a health check, or join a local club meeting. Small steps build confidence and prevent last-minute stress.

If paperwork feels overwhelming, ask for help. A local adviser, a bank officer, or a trusted neighbor can sit with you to organise documents. Use free community workshops to learn basic budgeting and benefits checks. Keep one folder — physical or digital — with passwords, documents, and contact details. Update it once a year or after major changes like moving or medical events.

Stay curious and flexible. Retirement often changes over time. Review your plan every six months and adjust steps as life shifts. Start with one small action today. We publish local guides and events weekly. Sign up for updates.

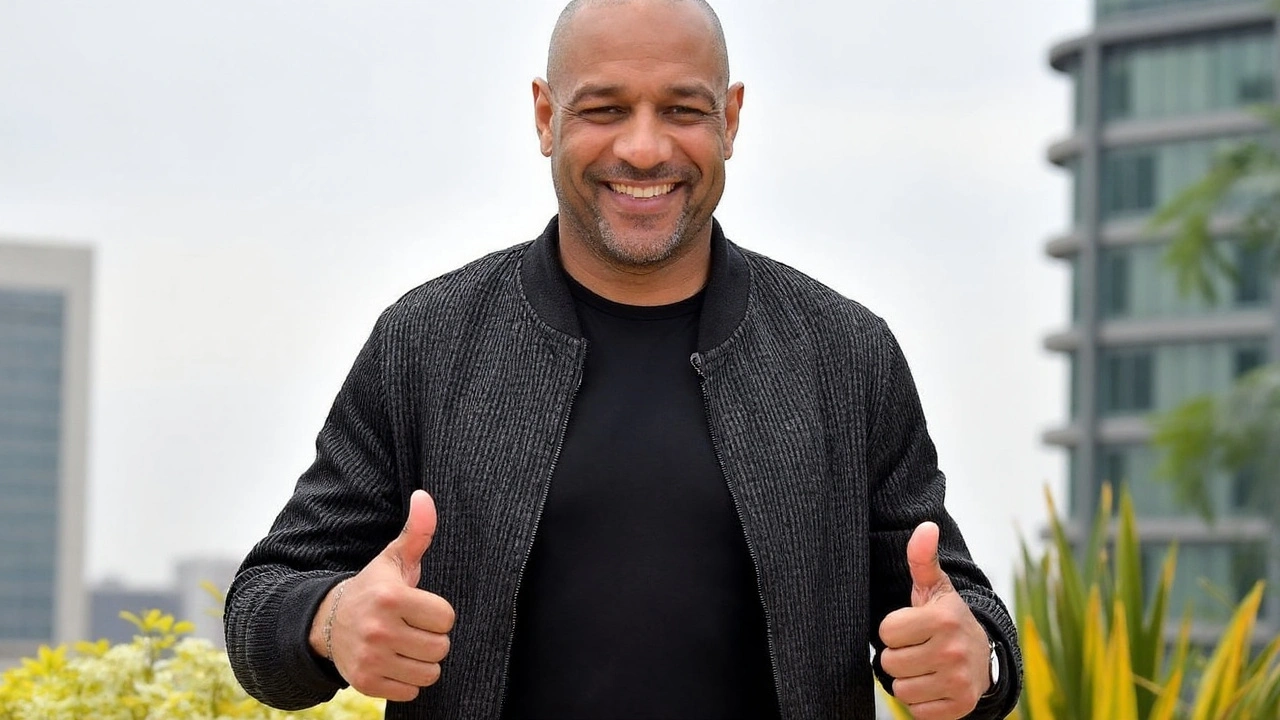

Brazilian superstar Adriano played his final match at Maracanã, officially retiring at 42. The emotional farewell saw former teammates and fans celebrating a career marked by dazzling highs and personal challenges, bringing an end to the cycle of a once unstoppable striker.

Read More